9 tips: How to be successful using expert advisors

In this article we want to show you, what we learned from the past few years about our own and many other traders failures using expert advisors (EAs) and want to give you our top tips to become successful.

We would like to start with a question that you may ask yourself:

Is it possible earn money fully automated using EAs and if yes, why doesn't everyone do it?

The reason why not everone is doing it is quite easy to answer. Most people just don't know about this possibility or are not willing to invest time + money to get used to automated trading.

We believe that it's possible to earn money fully automated using EAs, but there are many reasons why not everybody will manage to be successful.

Following our top tips will help you to become proftiable too on long term:

#1 - Avoid wrong entry and exit points

If you already tested a few EAs, did you ever asked yourself why most EA lose money as soon as you use them? And did you miss some good profits later, because you stopped using it?

That is maybe one of the biggest mistakes EA users are doing. They see a great live performance for the past 3-12 months and buy the EA. Often they set a risk higher than recommended by the EA author, don't do any own backtests and start trading with it on a live account. They often don't even know the maximum drawdown that could occur with the settings they use.

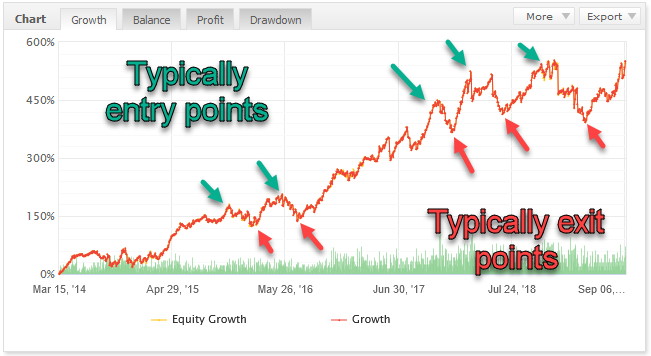

Typically users start and stop using an EA at the following time points:

No strategy is able to avoid losses completely, so such drawdowns will appear from time to time.

It's advisable to search for a good EA and wait for the next drawdown, before you start using it. If the strategy has an edge, it will recover and you will get a good boost at the beginning.

#2 - Set realistic expectations

There are many strategies out there that promise more than 15% or sometimes up to 50% per month. This may sometimes work for a few months, but after seeing hundreds of such "guaranteed profit" systems fail in the past 10 years, we recommend to start with more realistic expectations.

Beside using a strategy with strict risk management, we recommend to start with a low risk set up until you are sure what your comfortable risk level is.

For some people a maximum drawdown of 10% is already too high, for others 50% drawdown is still ok.

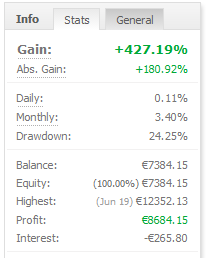

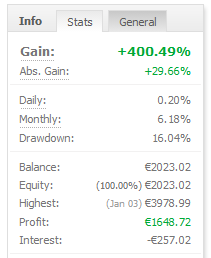

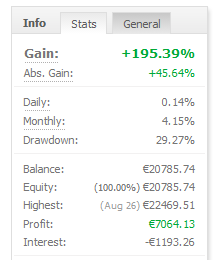

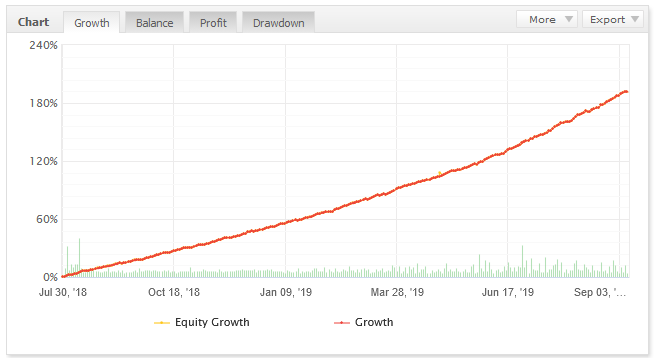

Below you see the results of a few automated trading systems with minimum 1 year live trading history showing different values for the maximum drawdown, which should be compared to the average monthly gain:

You can expect values like 1-6% per month with a maxium drawdown of 5-40%. Having values like 20% monthly gain with a maximum drawdown of 5% are not realistic in the long term.

Keep in mind that having 6% per month would already double your account in 12 months.

#3 - Avoid high risk trading strategies

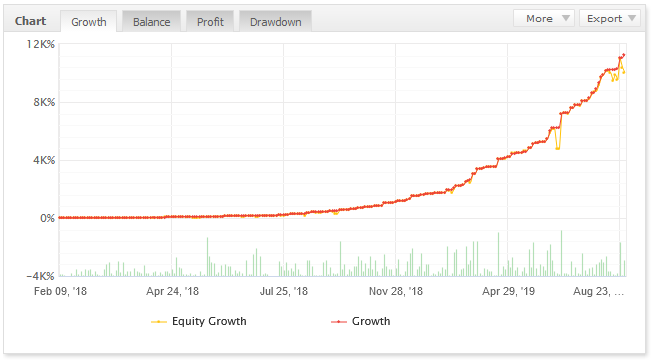

Many new trader search for strategies that show live results like this:

Or this:

Such strategies are often using grid (sometimes martingale too) methods and increase the risk step by step. The stronger the trend, the higher the drawdown will be. Sooner or later such systems will blow up a hole account if they don't use stop loss or limit the maximum risk.

We recommend to use strategies that are using a fixed stop loss per trade or per basket to protect your account and be profitable in the long term.

#4 - Choose a good broker

Many brokers charge pretty high tradings costs (spreads + commissions) that will make it impossible for strategies like scalper to earn money in the long term. Beside the trading costs, you need to consider many other aspects if you want to find a good broker.

Check out our article "How to choose a good forex broker" if you are unsure how good your broker is.

If you search for a broker with low trading costs, check out our spread and swap comparison tools.

#5 - Set your risk level and let the EA do his job

One of the most common mistakes new traders are making is to stop an EA too early, usually as soon as the first losing trades appear.

Every serious trading system will have a drawdown from time to time and it's important not to stop an EA during such periods as long as it stays within predefined limits.

We recommend to check the possible maximum drawdown based on your risk settings (by doing own backtests or asking the EA author) and not to stop an EA before this level is reached.

For example: If you set your risk of 3% risk per trade and your backtests are showing a maximum drawdown of 20% in the past, it would not be recommended to stop the EA after a drawdown of 10%.

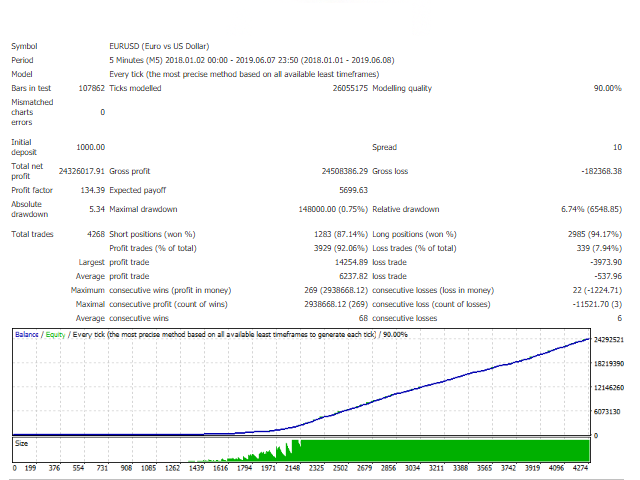

#6 - Avoid unrealistic backtests

It's quite simple to get unbelievably good backtests if you do it the wrong way.

There are many ways an EA seller, or you yourself, could produce unrealistic backtests. Here are some example:

- Using a fixed spread. Normally the spreads are relative stable, but especially during important events / news and everyday around roll over time, the spreads widen drastically. While some pairs could show spreads like 0.5 - 1.5 pips during normal trading hours, these could go up to over 20 pips (depending on your broker and the market liquidity). In case you are testing an Asian scalper, fixed spread backtests are quite useless.

- Poor data quality. It's important to use high quality backtest data. Some brokers provide data that have huge gaps. This leads to wrong backtest results.

- Many people try to test a tick scalper with a 90% data quality. Such data quality only provides M1 bars, but not tick data. In such cases the results compared to real tick data tests can be very different.

- Too short test period. It's always better to test / optimize an EA for a longer time period. Having positive backtests results for only a few months is quite simple. Having an EA that can produce positive results for over 10 years is much more complex.

Read our article about how we backtest all EAs, to find out more about this topic.

#7 - Avoid over-optimized backtest

Over-optimized backtests are another issue that leads to wrong conclusions. In such cases it could happen that the EA will only be profitable on backtests.

Over-optimization can happen in the following situations:

- In some rare cases, EA sellers put some code into the EA to avoid trading on a few very bad days in the past to produce better backtests results.

- Some EAs trade only like 5 times per year. The lower the trade frequency, the higher the chance for over-optimization.

- Trading at a very specific pattern that appeared in the past, but not in the future anymore.

Often the only way to find out if a EA is over-optimized is to test it on a live forward account.

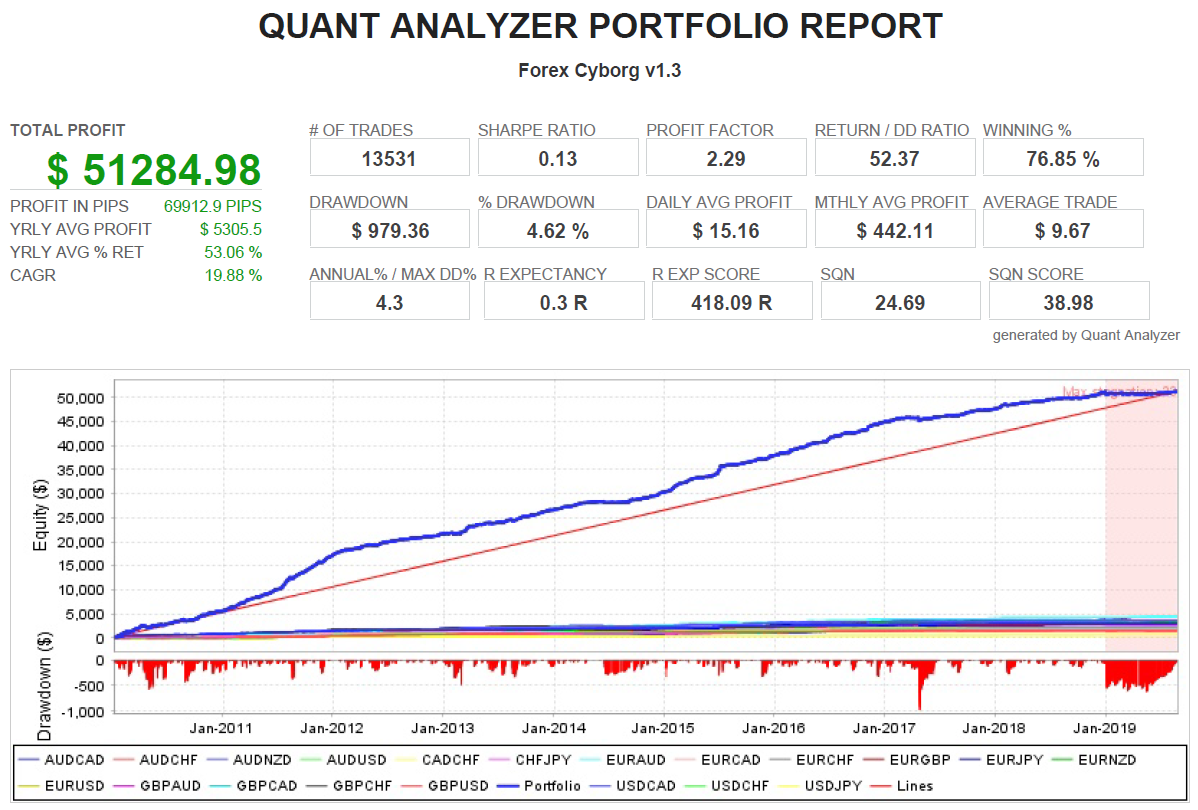

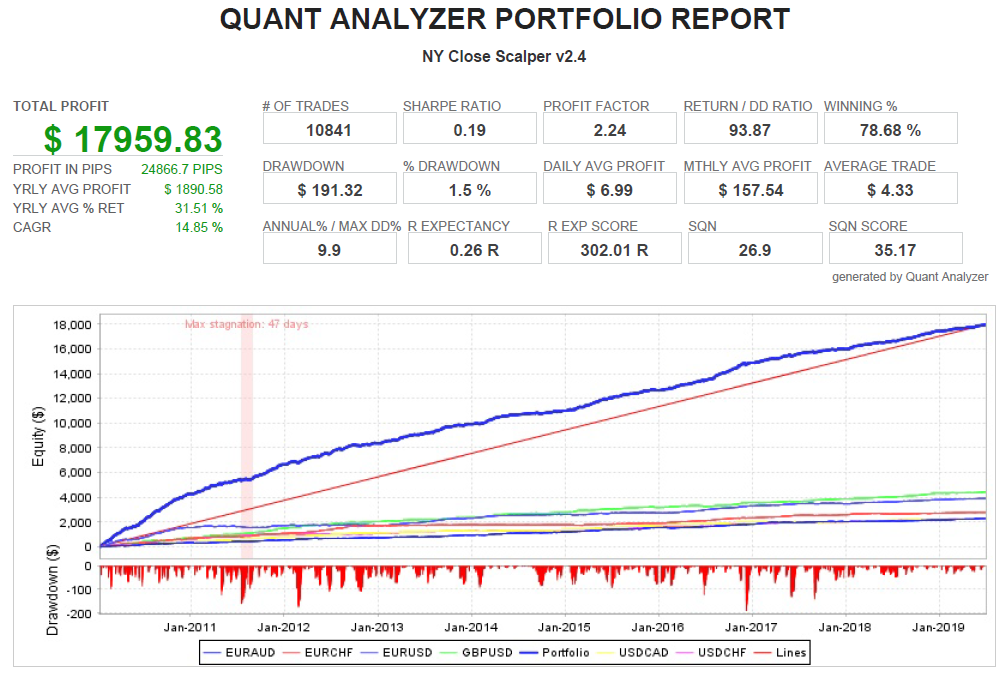

#8 - Building a portfolio

Diversity is another important key to success.

Don't put all your hope and trust in a single strategy. As already mentioned, every strategy will have a drawdown phase. Having another strategy that could absorb the loss at such points can lead to shorter drawdown phases and a more stable portfolio performance.

We recommend to build a portfolio of minimum three profitable strategies / EAs and to lower the lot size / risk for each strategy depending on the weight it has in your portfolio.

#9 - Do your own researchs

In the end we recommend you to do your own research. There are thousands of EAs out there and only very few people make realistic tests available to the public.

Many website that provide a list of the "best expert advisors" are testing like 20-50 EAs and often only those that pay enough to be listed on the website. Most oft the systems shown are using high risk trading methods, like grid or martingale.

The MQL-Marketplace does not offer the possibility to get a share of each sale as an affiliate, therefore most websites are not interested in offering free test results for the EAs that are listed there. But you are are able to download and backtest each EA yourself that is listed on this website.

We recommend you to do your own backtests before you buy an EA. In the next step we recommend you to test the EA on a demo account or a small real live account before you use it with larger funds.

Many EAs are available for rent. So take this opportunity and rent it for a few months, test it and buy it if you are confident about it.

All blog posts (7)

Recent blog posts

Useful forex websites

There are dozens of useful forex websites out there. We want to share some of them with you.

How to install an EA from the mql market?

A tutorial for beginners that do not have much experience with the MetaTrader 4 platform yet.

9 tips: How to be successful using expert advisors

Check out our 9 top tips on how to be successful using expert advisors (EAs) and why most forex trader fail using automated trading systems.

How we backtest an Expert Advisor

Find out what the limitations of backtests are and how we backtest the EAs on our website.

What is an Expert Advisor (EA)?

Expert advisors provide a unique way of trading Forex, as they help to eradicate emotion-based decisions. Find out, how an Expert advisor can help you.

How to choose a good forex broker (Part 2)

Choosing a good broker isn't easy. The following article can help you finding one of the best and top forex broker

How to choose a good forex broker (Part 1)

Choosing a good broker isn't easy. The following article can help you finding one of the best and top forex broker

Want to start trading on a live or demo account?

Be aware that most retail traders (usually around 60-80%) lose money. Please consider whether you can afford to take the risk of losing your money.