How to choose a good forex broker (Part 2)

> How to choose a good forex broker (Part 1)> How to choose a good forex broker (Part 2) |

The account

The trading accounts your broker provides are as important as everything else.

Some aspects to look out for include:

Types of accounts.

Depending on your trading strategy, some styles will demand different accounts.

For example, if you're a scalper, your main focus should be an ECN account which offers you tight spreads so as to reduce the costs incurred from every trade opened.

Almost all brokers have tier accounts depending on the deposits needed and features included. The higher the tier, the more benefits to the trader.

Trading costs: Spreads, commission and swap

One of the most important aspect to consider when selecting a good forex broker is the trading costs. These are split into spreads, commission and swap costs.

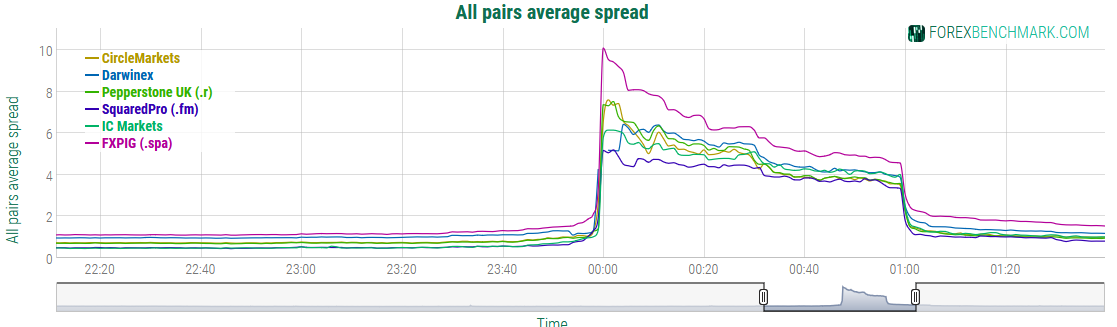

Spread is the difference in bid and ask price issued by a broker in every trade. They differ depending on account types and brokers.

Beside the spread, many brokers charge a commission, especially ECN brokers. In many cases the costs of the spread + commission are less, compared to a broker that offer commission-free accounts. Always check the overall costs per trade.

Our spread compare tool can help you choosing a broker with low fees: Spread compare tool

Our spread compare tool can help you choosing a broker with low fees: Spread compare tool

Swaps are also important for long term traders, that holding positions for many days.

A swap is the interest rate differential between the two currencies of the pair you are trading. When you keep a position open through the end of the trading day, you will either be paid or charged interest on that position.

Check out swap compare tool to find brokers with low swap rates: Swap compare tool

Deposit needed

Some brokers have a minimum of $5. Some have $10.000. Others lie anywhere in between. While you're choosing a good forex broker for yourself, look at their minimum deposits and how many features you'll get with that amount.

Choose only the amount of capital you're comfortable with losing.

Ease of deposits and withdrawals.

Some brokers have strict deposit and withdrawal regulations. Always check those terms to avoid getting your money locked in because you didn't follow their regulations.

Leverage

Most traders get excited at the prospect of getting high leverage. Leverage is a double-edged sword. If you wield it properly and gain profits, it increases them. If you lose money while having high leverage, the loses increase too.

The minimum offered is 1:1 while some brokers offer as high as 1:1000.

Always be wary of high leverage.

Execution Speed

It is important to have a broker who executes orders at the best available price and fast. For example, if you enter the market with a EUR/USD buy order at 1.1350, the order should be filled at that price.

Forex brokers with fast execution speed are important for scalpers.

Sadly, this point can only be checked in a live-trading environment.

The bonus you receive

Most beginner traders are always tempted to receive the free bonus issued by brokers. They think a good forex broker is one who gives them 'free money'.

The truth is, the bonus is used to entice traders to open an account. But when withdrawal time comes, you're not permitted to cash out until you've attained the broker's demands.

That amount you're asked to attain can be as high as 20× more.

A good advice could be to avoid such bonus.

All blog posts (7)

Recent blog posts

Useful forex websites

There are dozens of useful forex websites out there. We want to share some of them with you.

How to install an EA from the mql market?

A tutorial for beginners that do not have much experience with the MetaTrader 4 platform yet.

9 tips: How to be successful using expert advisors

Check out our 9 top tips on how to be successful using expert advisors (EAs) and why most forex trader fail using automated trading systems.

How we backtest an Expert Advisor

Find out what the limitations of backtests are and how we backtest the EAs on our website.

What is an Expert Advisor (EA)?

Expert advisors provide a unique way of trading Forex, as they help to eradicate emotion-based decisions. Find out, how an Expert advisor can help you.

How to choose a good forex broker (Part 2)

Choosing a good broker isn't easy. The following article can help you finding one of the best and top forex broker

How to choose a good forex broker (Part 1)

Choosing a good broker isn't easy. The following article can help you finding one of the best and top forex broker

Want to start trading on a live or demo account?

Be aware that most retail traders (usually around 60-80%) lose money. Please consider whether you can afford to take the risk of losing your money.