EA review - Asmani Pro

| Rating total: | |

| Backtests: | |

| Live performance: | |

| Risk control: | |

| Customizability: | |

| Price: |

| Vendor link | Price: | $125 (2021.05.28) |

| Trading strategy: | Grid |

| Vendor live account: | No |

| Own live account: | No |

| Latest tested version: | 21.3 |

| Latest tested date: | 2019.06.01 |

| Risk factors: | No exit on strong trends |

With version 21.3 of Asmani Pro, there is only one trading pair available: EURUSD

With 0.01 lot this EA reach a max. DD of $500-$800 (depends on the data you use for the trading), with a monthly return of $30. (All data based on backtests)

Trading Strategy:

Whenever market reaches to either Overbought or Oversold position based on M15 timeframe, Asmani Pro gets ready for the trade. The actual trade is taken when there is clear reversal of the trend from Overbought / Oversold position, based on 3 Indicators (RSI, MA and Bollinger Bands)

After opening first trade, if the market goes in wrong direction then Asmani again waits for second trade and it is again taken where there is one more reversal of trend.

In this way Asmani goes on opening the trades till number of trades reach to Order per Basket (OPB) given by user. (Default value is 5 orders)

The whole basket is closed when specific profit is reached as given by user as ProfitPerBasket. There is also a inbuilt “ReduceProfitPerTrade” feature, which will reduce the profit per basket if no of trades are more, so as to close the basket as soon as possible.

If “LockBasketCheck” is set true then after 5th trade in basket, Asmani start reversing the trades to reduce the DD. At Trade No. Specified as BasketLockPosition, Asmani locks the basket by opening equal buy and sell trades. This situation is very rare and used as FUSE for not blowing down the account.

Our opinion

The first impression is quite good. Limited Grid EA with max. 5 trades. However there was one case in 2013, when this Grid could not be closed. Because of this Asmani Pro hold the positions for over 12 months, before it opened new positions. That could have ended up in a margin call, depending on your deposit.Fixed lot size backtests

Why do we use fixed lot size (0.1 lots)? Check our educational page.

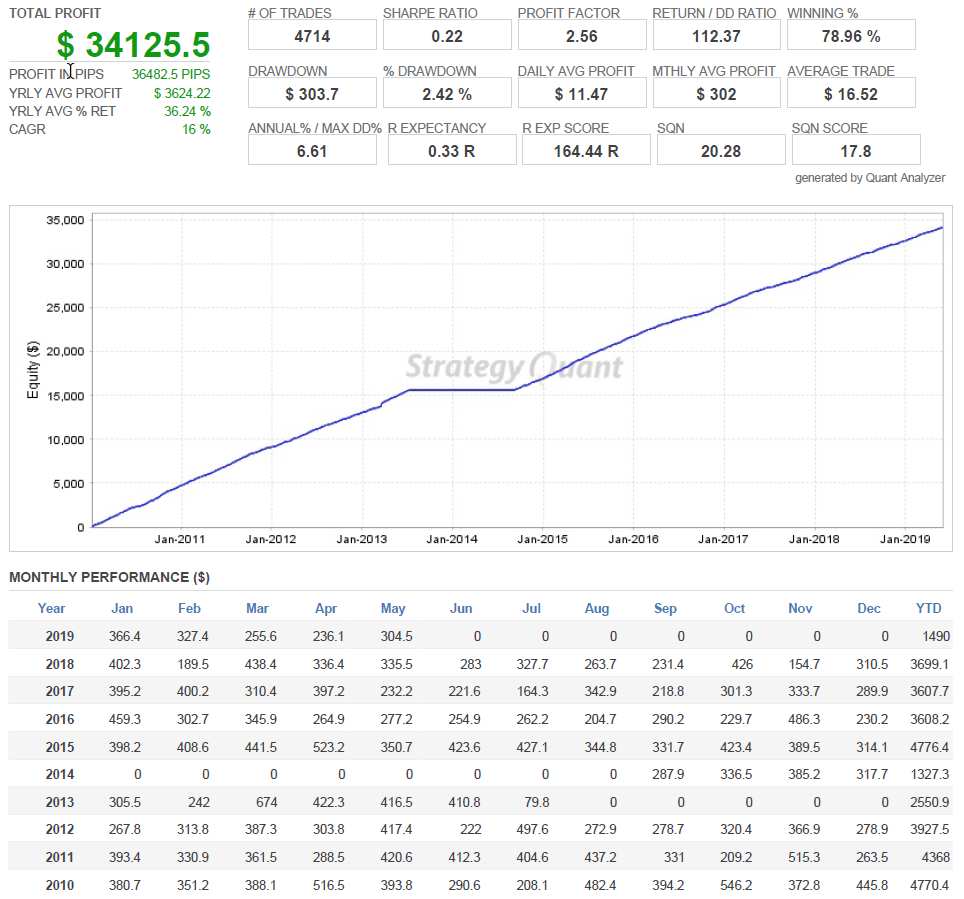

2019.06.01, version 21.3| Symbol | EURUSD (Euro vs US Dollar) | ||||

| Period | 15 Minutes (M15) 2010.01.01 00:00 - 2019.05.31 20:45 (2010.01.01 - 2019.06.01) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | Input00="PLEASE READ FOLLOWING BLOG"; Input01="https://www.mql5.com/en/blogs/post/725759"; MagicNumberSuffix="0"; AsmaniCom="Asmani_Pro21.3"; Input02="AUTO LOT SETTINGS --------------------------------"; AutoLots=false; Input03="AUTO LOTS CAPITAL (xxx amount per 0.01 lot)"; AutoLotsCap=400; Input04="FIX LOT MULTIPLIER (For 0.01 Lotsize, Set Multiplier = 1)"; LotMultiplier=10; Input05="MARTINGALE SETTINGS --------------------------------"; MartinAdd=false; Input06="MONEY IN TRADING CURRENCY FOR 10 PIPS MOVEMENT"; MoneyFor10Pips=1; Input07="PPB-PROFIT PER BASKET (IN YOUR CURRENCY) per 0.01 LOTS"; ProfitPerBasket=1; ReduceProfitSize=0.2; AddSpreadInProfit=true; AddSwapPercentageInProfit=100; AddCommInProfit=true; Input08="ORDER INPUTS --------------------------------"; OrdersPerBasket=5; MaxSpreadInPipsWhileOpen=3; MaxSpreadInPipsWhileClose=10; MinimumPipsGap=0; BuyOrdersCheck=true; SellOrdersCheck=true; CorelatedPairsMode=2; Input09="SAFETY INPUTS -----------------------------------------"; LockBasketCheck=false; BasketLockPosition=10; HedgeGapPips=15; ResumeAfterBasketLock=true; BasketLastOrderSLCheck=false; BasketLastOrderSLPips=200; ExitDDCheck=false; ExitDDperEquity=25; ResumeAfterDDLock=true; FIFOSLCheck=false; DontOpenBasketOnFriday=false; FridayNoBasketAfterHours=16; Input10="DISPLAY INPUTS --------------------------------"; LogCreateCheck=true; ProfitLineDisplay=true; StatusLinesDisplay=true; StatusLinesGap=11; StatusLinesXPos=900; StatusLinesFontSize=8; Input11="INDICATOR INPUTS --------------------------------------"; RSIValue=10; TopRSI=70; BotRSI=30; RSITol1=1; RSITol2=3; MACheck=100; TrendSlope=5; SlopeReduce=1; BB_Check=true; | ||||

| Bars in test | 234942 | Ticks modelled | 221967723 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 34125.50 | Gross profit | 55991.80 | Gross loss | -21866.30 |

| Profit factor | 2.56 | Expected payoff | 7.24 | ||

| Absolute drawdown | 188.80 | Maximal drawdown | 5008.20 (19.55%) | Relative drawdown | 19.55% (5008.20) |

| Total trades | 4714 | Short positions (won %) | 2361 (79.42%) | Long positions (won %) | 2353 (78.67%) |

| Profit trades (% of total) | 3726 (79.04%) | Loss trades (% of total) | 988 (20.96%) | ||

| Largest | profit trade | 235.90 | loss trade | -296.80 | |

| Average | profit trade | 15.03 | loss trade | -22.13 | |

| Maximum | consecutive wins (profit in money) | 40 (461.80) | consecutive losses (loss in money) | 4 (-89.80) | |

| Maximal | consecutive profit (count of wins) | 463.10 (16) | consecutive loss (count of losses) | -303.70 (2) | |

| Average | consecutive wins | 5 | consecutive losses | 1 | |

All EA reviews (15)

Latest EA reviews

AutoGenEA

An EA that is developed by Generic Machine Learning. Check it out

Momentum EA BOA

A momentum / trend following strategy with good and stable backtests.

Scalperinho EA

A very promissing EA that trades intraday pullbacks on a impressive number of 28 pairs.

StarX

A cheap night scalper with promising backtests. Check it out.

Inertia EA Extra

A S/R scalper for the EURUSD pair with an impressive backtest.

SFE Night Scalper

An asian scalper with a 4 years old live account. Check out our review

Aura MT4

A trend follwing system with inconsistent backtests.

SFE Stealth

Promising new Asian scalper with good live results. Check out our review.

FXStabilizer PRO

A martingale system which survived astonishing long in live trading

Mito EA

A trend / counter trend system that trades 31 different pairs. Check it out

FXAdept

A successful trend following EA with nearly two years of live history. Check out our review.

Bazava

A quite cheap intraday scalper for the NZDUSD. Is it worth the money? Check it out.

Tesseract

A counter-trend system with inconsistent backtests

Legend

A combination of a momentum based strategy and an SR level breakout system

CEF Phantom Scalper

An aggressive intraday counter-trend scalper on M1 time frame

Want to start trading on a live or demo account?

Be aware that most retail traders (usually around 60-80%) lose money. Please consider whether you can afford to take the risk of losing your money.