EA review - StarX

| Rating total: | |

| Backtests: | |

| Live performance: | |

| Risk control: | |

| Customizability: | |

| Price: |

| Vendor link | Price: | $269 (2020.01.13) |

| Trading strategy: | Night Scalper |

| Vendor live account: | No |

| Own live account: | No |

| Latest tested version: | v1.0 |

| Latest tested date: | 2019.10.28 |

| Risk factors: | Weekend gaps, calendar news, breaking news |

This EA has been removed from the market. If you are still interested, you could try to contact the seller directly via his profile.

StarX is a mean reversion system around the time of the end of the NY session. It only enters a single position per symbol with a small profit target. Positions are only held for a short duration.

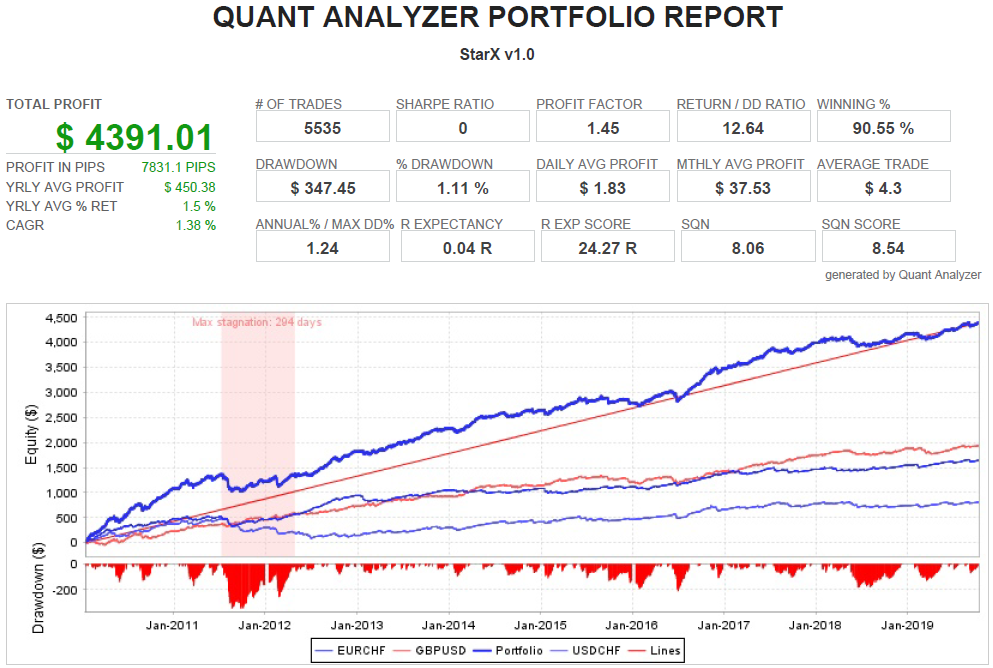

The following pairs are supported by the author: EURCHF, USDCHF, GBPUSD

However, our own backtests show several other pairs that have relatively good results with default settings. This is a good sign showing that a strategy is not over optimized.

The EA does not provide any news filter. A live account with a very short history was available, but was removed during the first drawdown.

The EA author often republished his EAs under new brands in the past. It seems that he prefers to replace an EA with a new one instead of updating an already existing one. Keep this in mind if you think about purchasing one of his EAs.

Our opinion

There are better EAs, like the NY Close Scalper, that have a similar trade logic, but most of them are more expensive.Fixed lot size backtests

Why do we use fixed lot size (0.1 lots)? Check our educational page.

Dukascopy 2019.10.28, version v1.0| Symbol | EURCHF (Euro vs Swiss Franc) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 731080 | Ticks modelled | 123661476 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 1644.91 | Gross profit | 4498.69 | Gross loss | -2853.78 |

| Profit factor | 1.58 | Expected payoff | 0.79 | ||

| Absolute drawdown | 5.77 | Maximal drawdown | 220.45 (2.09%) | Relative drawdown | 2.09% (220.45) |

| Total trades | 2079 | Short positions (won %) | 882 (92.52%) | Long positions (won %) | 1197 (92.23%) |

| Profit trades (% of total) | 1920 (92.35%) | Loss trades (% of total) | 159 (7.65%) | ||

| Largest | profit trade | 14.91 | loss trade | -29.78 | |

| Average | profit trade | 2.34 | loss trade | -17.95 | |

| Maximum | consecutive wins (profit in money) | 90 (221.65) | consecutive losses (loss in money) | 3 (-86.51) | |

| Maximal | consecutive profit (count of wins) | 221.65 (90) | consecutive loss (count of losses) | -86.51 (3) | |

| Average | consecutive wins | 13 | consecutive losses | 1 | |

| Symbol | USDCHF (US Dollar vs Swiss Franc) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 731231 | Ticks modelled | 124359019 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 810.68 | Gross profit | 3950.98 | Gross loss | -3140.30 |

| Profit factor | 1.26 | Expected payoff | 0.49 | ||

| Absolute drawdown | 2.95 | Maximal drawdown | 414.10 (3.94%) | Relative drawdown | 3.94% (414.10) |

| Total trades | 1668 | Short positions (won %) | 826 (85.59%) | Long positions (won %) | 842 (91.81%) |

| Profit trades (% of total) | 1480 (88.73%) | Loss trades (% of total) | 188 (11.27%) | ||

| Largest | profit trade | 23.05 | loss trade | -51.32 | |

| Average | profit trade | 2.67 | loss trade | -16.70 | |

| Maximum | consecutive wins (profit in money) | 57 (204.07) | consecutive losses (loss in money) | 3 (-78.88) | |

| Maximal | consecutive profit (count of wins) | 204.07 (57) | consecutive loss (count of losses) | -78.88 (3) | |

| Average | consecutive wins | 9 | consecutive losses | 1 | |

| Symbol | GBPUSD (Great Britan Pound vs US Dollar) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 731175 | Ticks modelled | 177206727 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 1936.52 | Gross profit | 5649.69 | Gross loss | -3713.17 |

| Profit factor | 1.52 | Expected payoff | 1.08 | ||

| Absolute drawdown | 54.24 | Maximal drawdown | 174.76 (1.54%) | Relative drawdown | 1.54% (174.76) |

| Total trades | 1788 | Short positions (won %) | 840 (90.48%) | Long positions (won %) | 948 (89.98%) |

| Profit trades (% of total) | 1613 (90.21%) | Loss trades (% of total) | 175 (9.79%) | ||

| Largest | profit trade | 23.14 | loss trade | -32.83 | |

| Average | profit trade | 3.50 | loss trade | -21.22 | |

| Maximum | consecutive wins (profit in money) | 56 (141.12) | consecutive losses (loss in money) | 4 (-93.30) | |

| Maximal | consecutive profit (count of wins) | 185.91 (55) | consecutive loss (count of losses) | -93.30 (4) | |

| Average | consecutive wins | 11 | consecutive losses | 1 | |

| Symbol | EURUSD (Euro vs US Dollar) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 731255 | Ticks modelled | 188420927 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 2120.88 | Gross profit | 5597.34 | Gross loss | -3476.46 |

| Profit factor | 1.61 | Expected payoff | 1.13 | ||

| Absolute drawdown | 4.52 | Maximal drawdown | 293.53 (2.72%) | Relative drawdown | 2.72% (293.53) |

| Total trades | 1871 | Short positions (won %) | 824 (90.90%) | Long positions (won %) | 1047 (89.02%) |

| Profit trades (% of total) | 1681 (89.85%) | Loss trades (% of total) | 190 (10.15%) | ||

| Largest | profit trade | 12.85 | loss trade | -28.27 | |

| Average | profit trade | 3.33 | loss trade | -18.30 | |

| Maximum | consecutive wins (profit in money) | 97 (220.17) | consecutive losses (loss in money) | 3 (-75.46) | |

| Maximal | consecutive profit (count of wins) | 220.17 (97) | consecutive loss (count of losses) | -75.46 (3) | |

| Average | consecutive wins | 10 | consecutive losses | 1 | |

| Symbol | AUDUSD (Australian Dollar vs US Dollar) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 729946 | Ticks modelled | 143692810 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 364.05 | Gross profit | 5113.74 | Gross loss | -4749.69 |

| Profit factor | 1.08 | Expected payoff | 0.19 | ||

| Absolute drawdown | 439.29 | Maximal drawdown | 507.14 (5.04%) | Relative drawdown | 5.04% (507.14) |

| Total trades | 1938 | Short positions (won %) | 871 (91.73%) | Long positions (won %) | 1067 (86.79%) |

| Profit trades (% of total) | 1725 (89.01%) | Loss trades (% of total) | 213 (10.99%) | ||

| Largest | profit trade | 20.93 | loss trade | -43.80 | |

| Average | profit trade | 2.96 | loss trade | -22.30 | |

| Maximum | consecutive wins (profit in money) | 79 (169.48) | consecutive losses (loss in money) | 4 (-87.11) | |

| Maximal | consecutive profit (count of wins) | 169.48 (79) | consecutive loss (count of losses) | -87.11 (4) | |

| Average | consecutive wins | 9 | consecutive losses | 1 | |

| Symbol | EURGBP (Euro vs Great Britain Pound ) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 731174 | Ticks modelled | 158727951 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 612.94 | Gross profit | 4842.63 | Gross loss | -4229.69 |

| Profit factor | 1.14 | Expected payoff | 0.28 | ||

| Absolute drawdown | 64.30 | Maximal drawdown | 285.51 (2.72%) | Relative drawdown | 2.72% (285.51) |

| Total trades | 2156 | Short positions (won %) | 980 (92.96%) | Long positions (won %) | 1176 (85.46%) |

| Profit trades (% of total) | 1916 (88.87%) | Loss trades (% of total) | 240 (11.13%) | ||

| Largest | profit trade | 95.24 | loss trade | -39.51 | |

| Average | profit trade | 2.53 | loss trade | -17.62 | |

| Maximum | consecutive wins (profit in money) | 56 (190.53) | consecutive losses (loss in money) | 3 (-85.63) | |

| Maximal | consecutive profit (count of wins) | 190.53 (56) | consecutive loss (count of losses) | -85.63 (3) | |

| Average | consecutive wins | 9 | consecutive losses | 1 | |

| Symbol | EURJPY (Euro vs Japanese Yen) | ||||

| Period | 5 Minutes (M5) 2010.01.04 08:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 730553 | Ticks modelled | 249099178 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 740.14 | Gross profit | 6201.08 | Gross loss | -5460.94 |

| Profit factor | 1.14 | Expected payoff | 0.36 | ||

| Absolute drawdown | 200.88 | Maximal drawdown | 436.80 (4.27%) | Relative drawdown | 4.27% (436.80) |

| Total trades | 2052 | Short positions (won %) | 1076 (86.90%) | Long positions (won %) | 976 (86.48%) |

| Profit trades (% of total) | 1779 (86.70%) | Loss trades (% of total) | 273 (13.30%) | ||

| Largest | profit trade | 43.06 | loss trade | -27.34 | |

| Average | profit trade | 3.49 | loss trade | -20.00 | |

| Maximum | consecutive wins (profit in money) | 44 (132.77) | consecutive losses (loss in money) | 5 (-107.15) | |

| Maximal | consecutive profit (count of wins) | 132.77 (44) | consecutive loss (count of losses) | -107.15 (5) | |

| Average | consecutive wins | 8 | consecutive losses | 1 | |

| Symbol | USDCAD (US Dollar vs Canadian Dollar) | ||||

| Period | 5 Minutes (M5) 2010.01.01 10:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 731117 | Ticks modelled | 138785396 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 1326.97 | Gross profit | 4213.18 | Gross loss | -2886.21 |

| Profit factor | 1.46 | Expected payoff | 0.81 | ||

| Absolute drawdown | 10.23 | Maximal drawdown | 103.84 (0.94%) | Relative drawdown | 0.94% (103.84) |

| Total trades | 1637 | Short positions (won %) | 736 (89.40%) | Long positions (won %) | 901 (91.34%) |

| Profit trades (% of total) | 1481 (90.47%) | Loss trades (% of total) | 156 (9.53%) | ||

| Largest | profit trade | 16.20 | loss trade | -25.65 | |

| Average | profit trade | 2.84 | loss trade | -18.50 | |

| Maximum | consecutive wins (profit in money) | 52 (198.40) | consecutive losses (loss in money) | 3 (-58.65) | |

| Maximal | consecutive profit (count of wins) | 198.40 (52) | consecutive loss (count of losses) | -58.65 (3) | |

| Average | consecutive wins | 10 | consecutive losses | 1 | |

| Symbol | USDJPY (US Dollar vs Japanese Yen) | ||||

| Period | 5 Minutes (M5) 2010.01.04 08:20 - 2019.10.09 23:55 (2010.01.01 - 2019.10.10) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | trade_comment=" EA StarX "; MM=false; Risk=3; ManLot=0.1; Pips=20; SL=200; TP=100; Slippage=10; Magic=28002; MaxSpread=30; GMT=2; hour_start=21; minute_start=30; hour_stop=22; minute_stop=50; Monday_Start_Hour=22; Monday_Start_Minute=0; Friday_End_Hour=15; Friday_End_Minute=0; | ||||

| Bars in test | 730543 | Ticks modelled | 145976893 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Variable | ||

| Total net profit | 1310.56 | Gross profit | 5792.95 | Gross loss | -4482.38 |

| Profit factor | 1.29 | Expected payoff | 0.61 | ||

| Absolute drawdown | 39.79 | Maximal drawdown | 373.13 (3.47%) | Relative drawdown | 3.47% (373.13) |

| Total trades | 2141 | Short positions (won %) | 1106 (83.73%) | Long positions (won %) | 1035 (91.40%) |

| Profit trades (% of total) | 1872 (87.44%) | Loss trades (% of total) | 269 (12.56%) | ||

| Largest | profit trade | 14.30 | loss trade | -33.39 | |

| Average | profit trade | 3.09 | loss trade | -16.66 | |

| Maximum | consecutive wins (profit in money) | 56 (164.51) | consecutive losses (loss in money) | 4 (-92.68) | |

| Maximal | consecutive profit (count of wins) | 164.51 (56) | consecutive loss (count of losses) | -92.68 (4) | |

| Average | consecutive wins | 8 | consecutive losses | 1 | |

All EA reviews (15)

Latest EA reviews

AutoGenEA

An EA that is developed by Generic Machine Learning. Check it out

Momentum EA BOA

A momentum / trend following strategy with good and stable backtests.

Scalperinho EA

A very promissing EA that trades intraday pullbacks on a impressive number of 28 pairs.

StarX

A cheap night scalper with promising backtests. Check it out.

Inertia EA Extra

A S/R scalper for the EURUSD pair with an impressive backtest.

SFE Night Scalper

An asian scalper with a 4 years old live account. Check out our review

Aura MT4

A trend follwing system with inconsistent backtests.

SFE Stealth

Promising new Asian scalper with good live results. Check out our review.

FXStabilizer PRO

A martingale system which survived astonishing long in live trading

Mito EA

A trend / counter trend system that trades 31 different pairs. Check it out

FXAdept

A successful trend following EA with nearly two years of live history. Check out our review.

Bazava

A quite cheap intraday scalper for the NZDUSD. Is it worth the money? Check it out.

Tesseract

A counter-trend system with inconsistent backtests

Legend

A combination of a momentum based strategy and an SR level breakout system

CEF Phantom Scalper

An aggressive intraday counter-trend scalper on M1 time frame